1.

Name, domicile and role

1.1

The name of the pension fund is the General Pension and Insurance Fund; the Fund operates with the organisation and for the purpose provided for in Act No. 155/1998 on its foundation, Act No. 129/1997 on mandatory pension insurance and the operation of pension funds and the Fund’s own statutes. The working name of the Fund is SL Pension Fund.

1.2

The Fund operates in three departments: the Mutual Insurance Department, the Specified Personal Savings Department and the Private Pension Department.

1.3

The role of the Fund is to ensure pensions for its members, their surviving spouses and their children in accordance with the provisions of law and the Fund’s statutes. The Fund places special emphasis on old-age pension insurance and reserves the authority to defend such entitlements over and above other entitlements. The Fund shall not engage in any activities other than the activities necessary to carry out its role, and no disbursements of funds may be made for any other purpose.

1.4

Where these statutes specify amounts in Icelandic krónur (ISK), their value shall be based on the value of the consumer price index to 513.0 (January 2022), and amounts shall be adjusted monthly in line with changes in the index, except where otherwise stated in the section in question.

1.5

The domicile of the Fund and legal venue are in Reykjavík [Iceland].

2.1

The obligation to pay contributions extends to all wage earners and persons engaging in business operations or self-employed persons from the age of 16 to 70 who have not fulfilled their insurance obligation through membership of another pension fund and payment to that fund in compliance with Act No. 129/1997 on mandatory pension insurance and the operation of pension funds.

2.2

No one may be denied membership of the Fund for reasons of health, age, marital status, family size or gender.

2.3

Members are all persons owning pension entitlements in the Fund and persons taking an old-age or disability pension.

2.4

The board of directors of the Fund is authorised to negotiate with the boards of other pension funds on their merger with SL Pension Fund. The board of directors shall ensure that the rights of Fund members are not curtailed as a result of the merger, and also that they are not improved at the expense of the members of the other funds. The board of directors of the Fund is also authorised to sell insurance coverage to other pension funds and co-operate with other pension funds regarding individual aspects of insurance coverage. Furthermore, the board of directors is authorised to offer to Fund members and other parties contracts on supplementary insurance coverage and private pension plans in compliance with Act No. 129/1997.

2.5

Contributions, and thereby the entitlements arising from them, may be transferred between pension funds when the taking of pension begins. Membership of the Fund is terminated when a Fund member has been paid his/her entitlements as a lump sum, of if they are transferred to another pension fund in accordance with rules of procedure governing relations between pension funds.

3.1

The Minister shall appoint seven members and two alternate members to the board of directors of the Fund for a term of four years. Four members and one alternate member shall be appointed following nomination by the Icelandic Pension Funds Association and three members and one alternate member shall be appointed without nomination. One of the members appointed without nomination shall be the chairman of the board of directors of the Fund; in other respects, the board shall allocate tasks among its members. The Minister shall decide on the remuneration to members of the board. The board shall maintain a record of minutes in which it shall enter all its decisions. A decision is lawful only if supported by the vote of the majority of the board of directors. Each of the genders shall be represented on the board of directors of the Fund. The minimum proportion of each gender shall be 40%. This applies to both the principal and alternate members of the board.

3.2

The board of directors of the Fund is responsible for its governance. The board shall deliberate on all major decisions regarding the policies and activities of the Fund. The board shall ensure that adequate supervision is maintained of the accounts of the Fund and the disposal of its assets. The board of directors shall establish statutes for the Fund in accordance with the provisions of Act No. 155/1997 on mandatory pension insurance and the operation of pension funds.

3.3

The members of the board of directors and managing director of the Fund shall be resident in Iceland and of legal majority; they shall have an unblemished reputation, they shall not at any time have been deprived of control over their estates, and may not, in the course of the preceding five years, have been convicted of a criminal offence relating to a commercial activity which is punishable under the Penal Code or legislation on limited liability companies, private limited liability companies, accounting, annual accounts, bankruptcy or public levies. However, board members resident in member states of the European Economic Area or in the Faroe Islands are exempt from the residency requirement.

3.4

The board of directors of the Fund shall appoint a managing director and establish rules of procedure governing his/her work. The managing director of the Fund is responsible for its daily operation in accordance with the policy and decisions of the board of directors. The managing director shall hire the employees of the Fund. The managing director of the Fund is not eligible to serve as a member of the board of the Fund. The managing director shall not participate in any business venture except with the permission of the board of directors. The educational qualifications and previous career of the managing director shall be such as to give assurance that he/she is able to fulfil his/her position in a responsible manner.

3.5

The Fund shall notify the Financial Supervisory Authority of any changes in its board of directors, managing director, auditor and actuary.

3.6

The board confers and withdraws signatory powers of the managing director and other employees.

3.7

The managing director shall provide the board of directors and auditors with any information that they may request concerning the performance and activities of the Fund.

3.8

Disqualification from participation in the process of individual matters is subject to the general principles of administrative law. Board members, the managing director and, as applicable, other employees, are required to disclose any circumstances that may cause their disqualification pursuant to the above. In such circumstances an alternate member shall take the seat of the principal member while the matters in question are discussed.

3.9

The board of directors, managing director and other employees, as well as the auditors of the Fund, are bound by confidentiality concerning any information which may come to their knowledge in the course of the performance of their duties and which may be confidential by law and by nature. The confidentiality shall be maintained after termination of service.

3.10

The board of directors shall employ a head of internal audit or negotiate with an independent supervisory body, plan the Fund’s investment strategy, establish rules on provision of information by the managing director and rules on securities trading by the board and employees of the Fund. The rules on securities trading shall be approved by the Financial Supervisory Authority. Also, the board of directors shall plan the internal control of the Fund and documented control procedures and organise a control system that enables the Fund to analyse, monitor, assess and control risk in the Fund’s operation.

3.11

The Fund shall have in its service an employee who is qualified to undertake the asset management of the Fund’s securities portfolios based on education and work experience. The employee shall also have passed an examination in securities trading in accordance with Article 53 of the Act on securities transactions.

3.12

The Fund shall appoint an employee to take responsibility for the analysis, measurement and reporting on risk; the appointment shall be notified to the Financial Supervisory Authority. If such employee leaves the Fund this shall also be notified to the Financial Supervisory Authority. The person responsible for risk management cannot be dismissed or transferred between jobs except with the approval of the board of directors.

The risk management of the Fund shall be independent of its other functional units. The Fund shall ensure that risk management has adequate funds and authority, inter alia to gather the information necessary for the activities of risk management. It shall be ensured that the person responsible for risk management has direct access to the board of directors of the Fund.

At a minimum, separation of jobs shall be ensured, as well as effective internal control in order to minimise possible conflict of interests.

3.13

The Fund is not permitted to grant loans to directors, their alternates, employees of the pension fund, auditors, oversight bodies, persons carrying out actuarial assessments of the financial situation of the Fund, or the spouses of these parties, unless they are members of the Fund; in such cases this must be done in accordance with the rules that apply to loans to Fund members in general.

4.

Annual general meeting

4.1

The board of directors shall announce the Fund's annual general meeting no later than by the end of June each year. All Fund members have the right to attend annual general meetings and to speak and submit motions. Motions shall be referred to the board of directors for process.

4.2

The announcement of the annual general meeting shall be made in a secure manner, at a minimum with a notice in daily newspapers seven business days before the annual general meeting.

4.3

At the annual general meeting the report of the board of directors, annual accounts, actuarial evaluations, investment policy and proposals for amendments to the Statutes shall be presented. Notwithstanding the provisions of Article 30 of Act No. 129/1997, the board of directors of the Fund is authorised to make amendments to the Statutes of the Fund that result directly from law or regulations.

5.1

5.1. The fiscal year of the Fund shall be the calendar year. Accounts shall be audited by a chartered accountant and the annual financial report shall be prepared in accordance with statutory law, regulations and accepted accounting standards.

6.1

The board of directors shall annually commission the calculation of its financial position as provided in Articles 24 and 39 of Act No. 1291997, and the result of the calculation shall form a part of the Fund’s financial statement at each turn of year.

6.2

A survey shall be carried out by an actuary or another party approved by the Financial Supervisory Authority for such work. The actuarial survey shall be sent to the Financial Supervisory Authority no later than 1 July each year.

6.3

If an actuarial survey reveals a difference of more than 10% between assets and pension obligations the board of directors of the Fund is required to make the necessary changes to the statutes of the Fund. The same shall apply if the difference, according to an actuarial survey, between assets and pension obligations has been over 5% for a continuous five-year period.

6.4

If an actuarial survey reveals that the financial situation of the Fund is unsecure, and if it may be inferred that assets will not cover liabilities the board of directors may, in consultation with an actuary, decide on a reduction in pension entitlements, provided that no other means of improving the Fund’s finances are available. However, entitlements cannot be reduced below the minimum entitlements that the Fund is required to provide according to the provisions of Act No. 129/1997.

7.

Investment powers and investment strategy

7.1

The board of directors of the Fund shall formulate and disclose an investment strategy for the Fund and its separate departments and invest the assets of the Fund and its separate departments in accordance with the following rules and within the limits laid down in this chapter.

- The Fund shall be guided by the interests of its members.

- The Fund shall take account of the age composition of its membership and other actuarial factors that have an impact on liabilities.

- All investments shall be based on an appropriate analysis of information, taking account of the security, quality, liquidity and profitability of the portfolio as a whole.

- The Fund shall ensure that its assets are sufficiently diverse to prevent concentration and accumulation of risk in the portfolio, e.g. by observing the correlation of the risk of individual assets and asset classes.

- The Fund shall establish ethical criteria for its investments.

7.2

The investment strategy of the Fund shall be based on classification of assets in accordance with the provisions of Section 7.5. Each type of deposit and financial instrument shall also be itemised, as applicable, taking into account currency risk and the size of each deposit entity or issuer. The Fund’s investment strategy shall be accompanied by a report on the manner in which the Fund complies with the rules of Section 7.1.

7.3

The Fund shall submit information concerning its investment strategy for the coming year to the Financial Supervisory Authority no later than 1 December each year.

7.4

The Fund is permitted to invest moneys intended to provide minimum insurance coverage in deposits with commercial banks and savings banks, financial instruments and real property, subject to fulfilment of the conditions laid down in Article 7.

7.5

The Fund shall classify the assets of the Fund into asset classes A-F as follows:

- Asset Class A

(a) Financial instruments issued or guaranteed by member states of the Organisation for Economic Co-operation and Development (OECD) or a member state if the European Economic Area or the Faroe Islands;

(b) Bonds secured by a mortgage on a real property, provided that the mortgage ratio does not exceed 75% of the market value of residential property or 50% of the market value of other real property at the time of lending.

- Asset Class B

(a) Financial instruments issued or guaranteed by municipalities or Municipality Credit Iceland;

(b) Deposits with commercial banks and savings banks;

(c) Bonds pursuant to the Act on covered bonds and corresponding bonds issued in a state within the European Area, a party to the Convention establishing the European Free Trade Association or the Faroe Islands.

- Asset Class C

(a) Bonds and money-market instruments issued by credit institutions and insurance undertakings, with the exception of claims which by contract are subordinated to other claims;

(b) Shares or unit certificates in collective investment undertakings (UCITS) pursuant to the Act on undertakings for collective investment in transferable securities (UCITS) or Directive 2009/65 on the coordination of laws, regulations and administrative provisions relating to undertakings for collective investment in transferable securities (UCITS).

- Asset Class D

(a) Corporate bonds and money-market instruments;

(b) Bonds and money market instruments issued by other funds for collective investment.

- Asset Class E

(a) Corporate equity instruments;

(b) Shares or unit certificates issued by other funds for collective investment;

(c) Real estate in member states of the Organisation for Economic Co-operation and Development (OECD) or member states of the European Economic Area or the Faroe Islands.

- Asset Class F

(a) Derivatives for the purpose of mitigating the Fund’s risk, or that involve only options to buy or subscription rights, provided that their benchmarks investment standards that comply with this Article, consumer price indices, securities indices, interest or the exchange rates of foreign currencies;

(b) Other financial instruments, with the exception of derivatives.

7.6

The Fund shall ensure that the weight of asset classes pursuant to Section 7.5 is within the following limits:

- Assets pursuant to points 3-6 in total shall be less than 80% of total assets;

- Assets pursuant to points 4-6 in total shall be less than 60% of total assets;

- Assets pursuant to points 6 in total shall be less than 10% of total assets.

Financial instruments pursuant to points 2-6 shall be listed in an organised securities exchange in a member state of the OECD or states within the European Economic Area, which operates on a regular basis, is open to the public and approved in a manner acceptable to the Financial Supervisory Authority, or a market outside member states of the OECD or states of the European Economic Area, provided that such market is approved by the Financial Supervisory Authority. Notwithstanding the first sentence, the Fund is permitted to invest in shares and unit certificates of funds for collective investment if there are provisions for permission for their redemption at the request of the Fund at any time.

Notwithstanding the above, the Fund is permitted to invest up to 20% of its assets in financial instruments that are not listed in an organised securities exchange. Furthermore, the Fund is permitted to invest up to 5% of its total assets in financial instruments that are listed in a multilateral trading facility (MTF) in member states of the European Economic Area that functions regularly is open to the public and approved in a manner acceptable to the Financial Supervisory Authority.

Financial instruments that are not listed in an organised securities exchange shall be issued by persons in the member states of the OECD or the states belonging to the European Economic Area.

If derivatives pursuant to point 5 of Section 7.5 are not listed in an organised securities exchange the Fund’s counterparty shall be subject to regulation acceptable to the Financial Supervisory Authority. It shall also be possible to calculate the value of such contracts daily in a reliable manner and it shall be ensured that such contracts can be sold, settled or closed on the same day at their real value at any time.

7.7

The Fund is permitted to invest up to 10% of its total assets in financial instruments issued by the same issuer falling within the scope of points 2-6 of Section 7.5. Of that figure, the Fund is not permitted to invest more than 5% of its total assets in financial instruments issued by the same issuer falling within the scope of points 6 of Section 7.5.

However, the Fund is permitted to invest up to 10% of its total assets in covered bonds issued by the same issuer in accordance with point 2 of Section 7.5.

The aggregate holding of the Fund in financial instruments according to the above and deposits in the same commercial bank or savings bank shall be less than 25%.

The Fund shall ensure that counterparty risk deriving from a derivative falls within the limits of paragraphs 1 and 3 above.

Persons pertaining to the same consolidation, or belonging to a group of related customers, cf. the Act on financial undertakings, shall be treated as the same person in calculations pursuant to this Article.

The Fund is not permitted to hold more than 25% of the unit certificates of a collective-investment undertaking or its individual sub-funds.

The Fund is not permitted to hold more than 20% of the shares in any company or unit certificates or shares in other funds for collective investment.

Notwithstanding the above, the Fund may hold a larger share than 20% in an undertaking that engages exclusively in providing services to the Fund.

7.8

The Fund shall limit its currency risk by ensuring that a minimum of 50% of the Fund’s total assets are held in the same currency as its liabilities.

The Fund is permitted to comply with the above condition using derivatives that limit currency risk in a similar manner.

7.9

The Fund shall at all times have in place a secure risk surveillance system for all its activities. The Fund shall at all times have in place adequate and documented internal processes that enable the Fund to analyse, assess, monitor and control risk in the Fund’s activities. Internal processes shall be reviewed regularly.

Risk Management shall play an active part in shaping the Fund’s risk policy and participate in major decisions on risk management. Risk Management shall be informed of all major or unusual trading by the Fund before it takes place.

The Fund shall, at a minimum annually, and any time there is a material change in its risk profile, conduct its own risk assessment. The risk assessment shall take account of all the principal risk factors that have been analysed in the Fund’s operations, estimate their potential impact and detail the principal actions that the Fund intends to take if a risk materialises. A report on the above risk assessment shall be presented to the board of directors and submitted to the Financial Supervisory Authority.

7.10

If an investment of the Fund exceeds permitted limits provided for in this Act the Financial Supervisory Authority shall be notified without delay and remedial measures taken immediately. The statutory maximum shall be achieved within three months, at the latest. However, the Financial Supervisory Authority may grant an extended deadline if this is clearly to the benefit of Fund members.

7.11

The Fund may not invest in chattels except to the extent necessary for the activities of the fund.

Notwithstanding the above, the Fund is permitted to take over assets without limitations to ensure the enforcement of claims. Such assets must be sold no later than within 18 months of their acquisition. However, further deferral of the sale is permitted if the deferral clearly serves the interests of the Fund. Such deferral of the sale of assets must be notified to the Financial Supervisory Authority, which may require their sale within a reasonable deadline.

The Fund is not permitted to borrow, except for the purpose of investing in real estate which is necessary for the activities of the fund. However, the Fund may take advantage of normal trade credit in purchasing securities or take short-term loans to even out cash flows.

The Fund is not permitted to extend loans to directors, their alternates, employees of the pension fund, auditors, regulatory bodies, persons carrying out actuarial surveys of the financial situation of the fund, or the spouses of such persons, unless they are members of the Fund, and then only in compliance with the rules that apply to loans to Fund members in general.

7.12

Article 7 applies to the investments of both departments, i.e. the Mutual Insurance Department and the Personal Savings Department. The Article thus applies equally to moneys that are invested and intended to provide supplementary insurance coverage.

8.1

Contributions to the Fund shall at a minimum amount to 12% of the contribution base pursuant to Section 8.2. In the case of employed persons, 4% shall be paid by the wage earner and the remainder by the employer.

8.2

The contribution pursuant to Section 8.1 shall be calculated from the total of wages paid and any consideration paid for work, function and service of any kind. The contribution base shall comprise all types of wages or remuneration for work which is subject to income tax pursuant to the first paragraph of Point 1 of Section A, Article 7, of Act No. 90/2003 on income tax and net worth tax. The contribution base shall not, however, include benefits paid in kind, such as clothing, food or accommodation, or payments which are intended to cover expenditures, e.g. vehicle allowances, per diem payments and food allowances. Also, the contribution base shall not include old-age pensions. The contribution base shall include unemployment benefits, as provided for in the Unemployment Insurance Act. The contribution base of an individual who is employed in his/her own business operations or self-employed shall be equivalent to an amount provided for in the second Paragraph of Point 1 of Section A, Article 7, of Act No. 90/2003 on income tax, cf. Article 59 of the same Act.

8.3

The Fund is permitted to accept supplementary contributions paid in excess of the minimum contribution pursuant to Sections 8.1 and 8.2. The supplementary contribution may accrue to earning pension entitlements in the mutual insurance plan or personal savings plan. If the supplementary contribution is to accrue to the mutual insurance plan, then the Fund member in question shall pay a full minimum contribution to the Fund’s Mutual Insurance Department. Payment of the minimum contribution and the supplementary contribution shall take place simultaneously if the supplementary contribution accrues to the Mutual Insurance Department. The supplementary contribution may be paid without a specific matching contribution. A Fund member may dispose of contributions in excess of 12% of the contribution base into a specified personal savings department, if provided for in a collective agreement or employment contract, see Article 18.

8.4

Employers are required to withhold their employees’ contributions and submit them monthly together with their own share of the contributions. The due date for each month is the tenth day of the following month, and the final due date is the last day of that month. If a payment has not been received on the final due date, the highest default interest that credit institutions are permitted to charge by the Central Bank of Iceland shall accrue from the due date to the date that payment is made. Employers and persons operating their own businesses are required to notify the Fund if they are no longer responsible for submitting pension fund contributions due to the termination of their activities or if their employed persons have left their employment.

8.5

The board of directors of the Fund is permitted to collect a charge of up to 4% of contributions in respect of contributions that the Fund is required to collect in conformity with Article 6 of Act No. 129/1997. The charge may be deducted from the contribution prior to its entry in the entitlements ledger. If the Fund entrusts the collection of the contributions to a competent third party, where calls by the Fund for their payment have not been heeded, the resulting cost shall be paid by the person at whom the collection efforts are directed.

8.6

Fund members are not liable for any obligations of the Fund beyond the payment of their contributions.

8.7

Contributions in respect of Fund members that an employer has demonstrably withheld but not submitted to the Fund, together with the matching contribution of the employer shall, notwithstanding the default, accrue to entitlements for the benefit of the member in question when pensions are allocated, provided that the Fund was aware of the default. However, the Fund is not liable for entitlements of Fund members relating to contributions lost as a result of bankruptcy and for which the Wage Guarantee Fund is not liable in accordance with Article 6 of Act No. 53/1993. (These are board members and managers of a bankrupt enterprise, their spouses and relatives, as further provided in the rules of the Wage Guarantee Fund).

8.8

Fund members shall semi-annually be sent a statement of contributions paid for their benefit. The statement shall be accompanied by a request to Fund members to comment promptly in the event of any shortfalls in submissions of contributions. The Fund shall at the same time, by means of a public notice, advise all those who purport to have paid contributions to the Fund in the preceding period and have not received a statement pursuant to the above to inform the Fund promptly of any purported default. If no comments have been received from a Fund member, supported by wage slips, within 60 days of the date of a statement, and the Fund was not aware of the contribution claim, the Fund is only liable for entitlements based on such contributions to the extent that they are paid in. The Pension Fund shall, concurrently with the statement and no less frequently than once each year, send information on earned and anticipated pension entitlements of Fund members, on the operation and financial situation of the Fund, and on amendments made to Statutes. The same information shall be sent to Fund members who have reached pensionable age. Statements may be sent to Fund members in electronic form if they so request.

9.

Basis of pension entitlements

9.1

The entitlements of Fund members to a pension are calculated in Icelandic krónur, with the entitlements determined on the basis of the contribution paid into the Fund at any time. The reference age for the calculation of minimum insurance coverage, as provided in Section 6.1 of Regulation No. 391/1998 on mandatory pension insurance and the operation of pension funds, is 25 to 64 years, both years included. Articles 10-13 specify the methods of calculating Fund members’ entitlements. The calculations are based, inter alia, on the entitlement tables, which constitute a part of the statutes. New entitlement tables shall be calculated annually. If the new entitlement tables return a result that alter the future liabilities of the Fund by more than 1% the new tables shall take effect as of the following turn of year. Otherwise, the earlier entitlement tables will remain in effect.

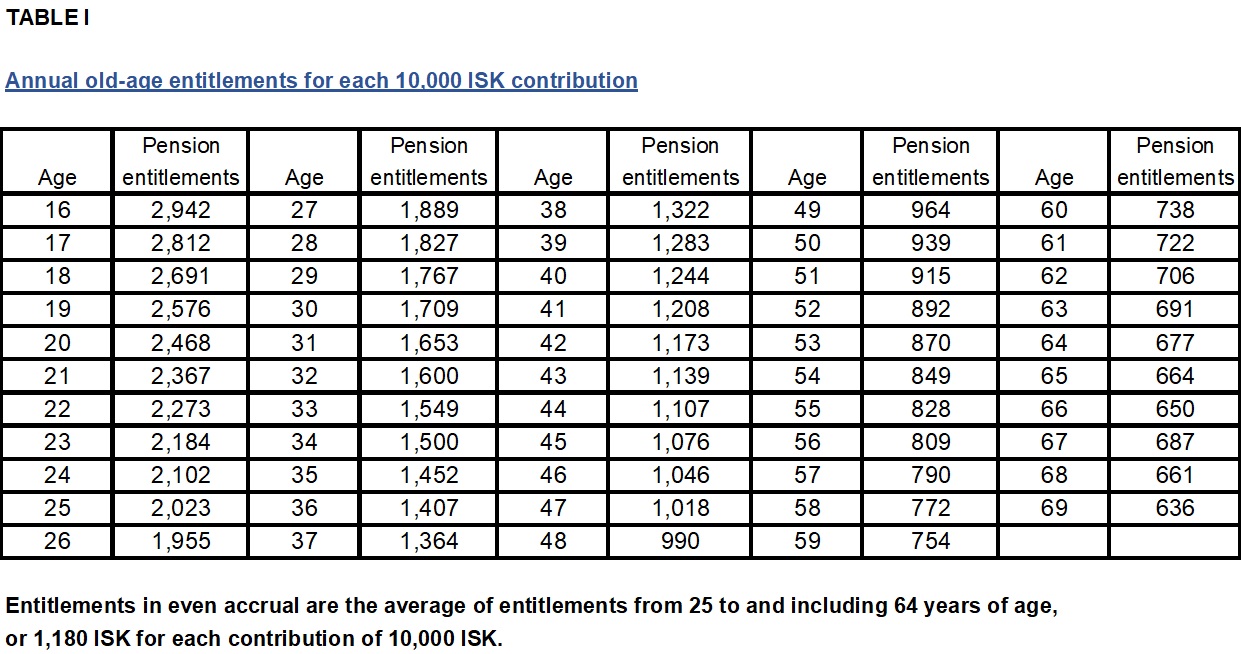

9.2

The accrual of entitlements is determined by the age of a Fund member at the end of the salary month in respect of which a contribution is paid, all in accordance with Table I in the Annex, subject to Section 9.3. The entitlements are index-linked and adjusted in line with the consumer price index from the salary month in respect of which a contribution is paid. The pension entitlements are defined in Articles 10 to and including 13, subject to the provisions of the articles providing for continuing even accrual of entitlements.

9.3

A Fund member holding entitlements in the Fund at year-end 2005 is permitted to pay contributions into the Fund up to a specified maximum with an even accrual of entitlements over as many months as the member had paid contributions to the Fund prior to the age of 42 at year-end 2005. If the member has paid contributions for a full five years over the period in question, the member is entitled to pay up to the reference contribution in an even accrual of entitlements until the age of 70. This even accrual is based on the average entitlement accrual of the ages 25 to and including 64 according to Table I in the Annex, where the average is listed separately in the form of entitlements for each contribution of ISK 10,000.

9.4

The maximum contribution toward even accrual each calendar year, the reference contribution, shall be determined for each Fund member at the age of 25 years to and including 69 years, equal in amount to the contribution he or she paid into the Fund in 2003, or the last year that a contribution was received by the Fund for his or her benefit, if earlier. However, the reference contribution shall not take into account payments of contributions in excess of 10% of the contribution base. If payments of contributions in that year do not reflect normal payments, e.g. as a result of interruptions in employment or as a result of payments having ceased in the year, the calculation of the reference contribution shall, following an application by the Fund member, be based on contribution payments in respect of an earlier year that the board of directors of the Fund considers to give a fair view of the regular contribution payments of the Fund member. The reference contribution pursuant to the above shall be adjusted in line with changes in the consumer price index from the reference year to the year of payment each given time.

9.5

All contributions received by the Fund in respect of a Fund member who is 25 years of age or older at year-end 2005 and has a defined reference contribution in accordance with the above shall be entered in an even entitlement accrual until the reference contribution is reached or the calculated contribution payment period is completed. The Fund shall specifically take care that the entitlement accrual of persons who are not entitled to an even entitlement accrual until the age of 70 pursuant to Sections 9.3. and 9.4 is in accordance with the accrual rules that confer greater entitlements over the period in question. A contribution that is received in excess of the above reference contribution forms entitlements in accordance with the Fund’s age-dependent entitlement table. When all the contributions of a year have been received in respect of a Fund member possessing a defined reference contribution, such contributions shall be entered as entitlements with the part of the contributions of the year accruing to even entitlement accrual, distributed over the months of the year in proportion to the total contributions. The balance is entered as age-dependent accrual.

9.6

If contributions are not paid in all of the months of a calendar year, then the reference contribution of that year shall be calculated proportionally to the number of the months in respect of which contributions were paid.

9.7

In projecting entitlements in accordance with the provisions of Articles 11-13, an even accrual shall be assumed in accordance with the share of the Fund member’s reference contribution in the contributions that formed the basis of the projection.

9.8

The Fund shall inform Fund members of the calculation of the reference contribution for even entitlement accrual pursuant to the above within five months from the time that the member first pays a contribution to the Fund after 1 January 2006. If a Fund member is of the opinion that the reference year does not give a fair view of his or her normal contribution payments, he or she may submit a request to the board of directors of the Fund for another year to be used as a basis for the calculation of the reference contribution. The request for a review of the reference contribution shall be received by the Fund at the latest nine months after the Fund member received a notice of the calculation of the reference contribution.

9.9

A reference contribution shall not be calculated for members who are under the age of 25 or over the age of 70 on 1 January 2006. A Fund member can at any time decide that his or her contribution should accrue to entitlements in accordance with the age-dependent entitlement table. A decision by a Fund member to such effect shall take effect from the beginning of the year in which the notice is received by the Fund; the decision is irrevocable. The right to even accrual pursuant to the provisions of this chapter applies from 1 January 2006, or from the time that a member is first permitted to contribute to the Fund in respect of wages for work in his or her profession and shall lapse if it is not exercised without reasonable explanation in the opinion of the board of directors.

9.10

The board of directors of the Fund is authorised to enter into an agreement with other pension funds within the Icelandic Pension Funds Association that have used a system of even accrual of entitlements in 2003 on a mutual recognition of contribution payments for the calculation of a reference contribution pursuant to the above. Also, the Fund is permitted to maintain a harmonised computer record in co-operation with other pension funds of entitlements to even accrual and to decide how these entitlements should be divided if contributions are paid into more than one pension fund.

9.11

Accrued entitlements, as defined in Sections 10-13 and calculated in accordance with Sections 9.2 and 9.3, shall be preserved in accordance with the rules that are current at any time, so that pension payments are in line with the accrued entitlements of each entitlement period. Projection shall at each given time be in accordance with the rules that apply when the entitlement to a pension became active. The aggregate of pension entitlements is the sum of accrued pension entitlements and projected pension entitlements if such entitlements have been decided. Projected pension entitlements are not counted with accrued entitlements except to the extent that they have accrued from the time of decision to the time of projection, as provided in Sections 11.18 and 12.7. When the board of directors decides on an increase in entitlements, such entitlements shall be segregated from other entitlements. An increase in entitlements is not included in projections, but counts fully in accrued entitlements. In the event of a curtailment of accrued entitlements of Fund members, the procedure shall be the same as in the case of increases in entitlements, with the exception that the curtailment is deducted from accrued entitlements.

9.12

If contributions do not accrue to entitlements because a Fund member has reached 70 years of age, or has not reached 16 years of age, at the time of payment of contributions, their reimbursement shall be subject to the provisions of Article 15.

9.13

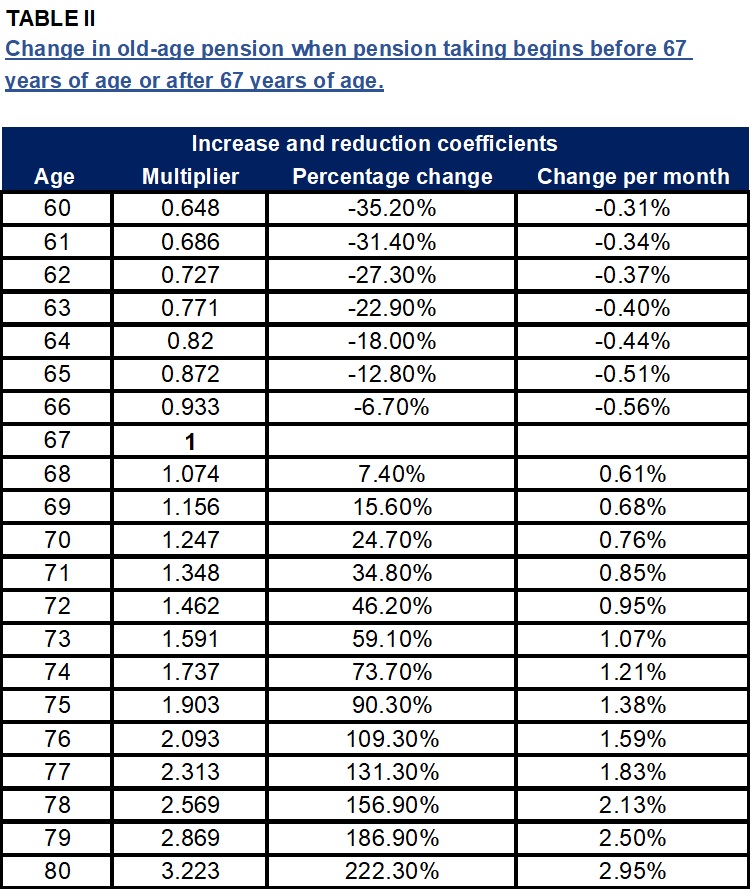

Accrued entitlements of Fund members in respect of contributions until the end of 2005 shall be preserved in accordance with the rules that were in effect at the time in question. They shall be converted into an amount in Icelandic krónur based on the accrued points for each year and the base pay that applied at year-end 2005. They shall subsequently be adjusted monthly in accordance with the consumer price index. The effect of deferral or bringing forward of a pension amount pursuant to this Article is subject to Tables II and III in the Annex.

9.14

The allocation each year to even out the disability burden of the pension funds, as provided in Act No. 113/1990 on payroll tax, shall be allotted in accordance with the provisions of Article 19 of Regulation No. 391/1998 on mandatory pension insurance and the operation of pension funds, and create entitlements in accordance with the following rules:

- The future value of the allocation shall be assessed as the same proportion of the value of future contributions in an actuarial survey as the proportion of the allocation to the contributions of the year that are subject to projection. The discounted amount shall constitute an asset in in the same manner as future contributions.

- The Fund will assess the increase in entitlements that can be granted to Fund members as a result of the discounting of the contribution, and entitlements shall be increased by the proportion of the amount of the allocation to future liabilities as they were prior to the change. However, entitlements shall not be increased if the value of assets, with the addition of the future value of the allocation, falls short of liabilities; in other respects, the provisions of Article 39 of Act No. 129/1997 apply.

- Where the Fund has allocated moneys to increase entitlements and/or raise the entitlement table, then the liabilities resulting from such entitlements shall be assessed at their present value in the manner provided for in Chapter IV of Regulation No. 391/1998 and shall be in balance with the allocations capitalised in accordance with Point 1 above, cf. Article 39 of Act No. 129/1997.

10.1

10.1. All Fund members, having reached the age of 60, are entitled to an old-age pension from the Fund.

10.2

The annual old-age pension of a Fund member who begins taking an old-age pension is equal to the sum of his/her pension entitlements calculated in accordance with Sections 9.2 and 9.2 based on the tables in Annex A, subject to the provisions of Section 17.3 on mutual and equal division of old-age pension entitlements.

10.3

When a Fund member begins taking an old-age pension after the age of 67, the amount of the old-age pension shall increase in line with Table I, as shown in Table III, for each month that passes from the age of 67 until the taking of the old-age pension begins. The taking of an old-age pension may be deferred to an age not exceeding 80 years.

10.4

When a Fund member begins taking an old-age pension before the age of 67, the amount of the old-age pension shall decrease in line with Table I, as shown in Table II, for each month remaining until the age of 67 at the time that the taking of the old-age pension begins.

10.5

If a Fund member continues to earn entitlements after beginning to take an old-age pension his/her entitlements shall be reviewed at the age of 67 if the taking of an old-age pension began before that age, and then again at the age of 70, also if the taking of an old-age pension began before that age. If the taking of an old-age pension first began at the age of 70 or later, then no review is necessary, as contributions after the age of 70 will then have been reimbursed, as provided in Section 15.2. Entitlements are subsequently calculated again no later than at the age of 80. Entitlements resulting from contributions after the age of 67 shall be calculated in accordance with Table II in Annex A

10.6

A Fund member who has not begun to take an old-age pension from the Fund may decide to begin taking a 50% old-age pension any time after reaching the age of 65 years, in which case he or she shall be regarded as having exercised that part of his or her old-age pension entitlements as described in Section 10.9. Section 10.4 shall apply to the part that is disposed of before the age of 67 years. Section 10.3 shall apply to the deferred part after the age of 67 years.

10.7

Old-age pension is paid monthly, life-long, based on accrued entitlements.

10.8

When a Fund member begins taking an old-age pension that decision is final. The right to a disability pension therefore lapses from the time that taking an old-age pension begins.

11.1

A Fund member who suffers a loss of ability that is regarded as amounting to 50% or more according to Section 11.3 and who has paid into the Fund for a total of two years is entitled to a disability pension from the Fund in accordance with accrued entitlements in accordance with Article 9 up to the time of loss of ability.

11.2

The right to a disability pension is not established if the Fund member has not suffered a loss of income due to the disability. The total of a disability pension and child pension according to Article 13 shall never exceed the loss of income demonstrably suffered by the Fund member as a result of his/her disability. In assessing loss of income, account is taken of the disability pensioner’s employment income, pension payments and benefits received from Social Security and issued by other pension funds, and benefits received under collective agreements as a result of the disability. The board of directors may require testimonials from the Directorate of Internal Revenue, employer, etc. for purposes of verification.

In determining whether any loss of income has occurred as a result of the disability, the Fund member shall be determined a reference income which shall be the average of the Fund members’ income in the last four calendar years preceding the loss of ability, with price level adjustments to the date of determination, as provided in Section 11.4 on projections. The average of the income of the three calendar years preceding the disability may be used as a basis in the case of Fund members who have been awarded a disability pension prior to 1 January 2006. From the date of determination, the reference income shall be adjusted in line with changes the wage index.

11.3

The percentage and timing of a disability shall be decided after information has been received on the past health history and the capacity of the applicant for work, together with the opinion of the Fund's medical officer. For the first five years following the onset of the disability the assessment shall be based mainly on the impaired ability of the Fund member to perform in the post he/she has held and with which his/her Fund membership is associated. After that period the disability percentage shall be redetermined with respect to the impaired ability of the Fund member to perform general tasks.

11.4

On the recommendation of the medical officer, the condition may be set for payment of a disability pension that the Fund member undergo rehabilitation which could lead to his/her improved health, provided that such rehabilitation is available and that the member’s circumstances permit him/her to take advantage of the rehabilitation. When the conditions of Section 11.1 and this section have been fulfilled, the maximum disability pension shall be based on the accrued pension entitlement pursuant to Article 9, in addition to a pension corresponding to the entitlements that the Fund member may be assumed to have earned to the age of 65, calculated in accordance with Section 11.9, provided that the Fund member has:

- paid contributions to the Fund for no less than three out of the preceding four calendar years and no less than ISK 133,826 in each of those three years;

- paid contributions to the Fund for a minimum of 6 months out of the preceding 12 months;

- not suffered loss of ability which can be attributed to abuse of alcohol, pharmaceuticals or drugs.

11.5

If a Fund member is also entitled to a disability pension from another Fund, he/she shall only enjoy projection rights from this Fund if he/she last paid contributions to this Fund.

11.6

If a Fund member has changed jobs and begun for that reason to pay contributions to this Fund in the 24 months preceding the loss of ability, no entitlement to projection is created in this Fund if the change of jobs can be traced to deteriorating health that led to the loss of ability.

11.7

If a Fund member has earned a right to projection of income that has lapsed as a result of temporary absence from the labour market owing to work abroad, study, leave of absence, childbirth, or comparable reasons, his/her right to projection shall become effective once more no later than six months from the time that he/she resumes work and payment of contributions to the Pension Fund.

11.8

If there are special circumstances, such as the age of the Fund member, his/her residence abroad or study, that have the effect that he/she has been unable to meet the conditions of Section 11.4(a), the board of directors of the Fund may shorten the required period to the two preceding calendar years, provided that it is assured that the cause of the disability cannot be traced to a time prior to the loss of ability.

11.9

If a Fund member, who has not reached the age of 65 when he/she suffers a loss of ability, is entitled to projection of income pursuant to Section 11.4, the projection shall be calculated on the basis of an average of contributions of Fund members over the three years preceding the loss of ability. If the board of directors of the Fund is of the opinion that this four-year average is unfavourable for the Fund member because of absence due to sickness or unemployment, the board is permitted to use the average of contributions over a greater number of years into the past and exclude the poorest calendar year from the average.

11.10

If a Fund member has suffered a partial loss of general capacity for work before the time that he/she began to pay contributions to the Fund, and his/her loss of ability may be assessed at 50% or more, an average of his/her contributions shall be calculated for all the years that he/she has paid contributions to the Fund. In such cases, the projection shall be based on that average.

11.11

Where payments of contributions by a Fund member to the Fund have been so sparse that they have lapsed or corresponded to less than ISK 892,174 in annual salary for more than one calendar year following the end of the year when the Fund member reached the age of 25 years, the period of projection shall be shortened by the proportion between the number of calendar years when annual contributions corresponded to an annual income below ISK 892,174 and the number of calendar years from the age of 25 years up to the time of loss of ability. The same applies if sparse payments of contributions are due to an evasion of the obligation to contribute to a pension fund

11.12

If the annual average of contributions on which projection is to be based pursuant to Sections 11.9 or 11.10 exceeds ISK 892,174, then the average shall be used for up to ten years; thereafter, up to the age of 65, the calculation shall be based on ISK 892,174 per year in addition to one-half of the contributions in excess thereof.

11.13

If the illnesses that are the cause of the disability of the Fund member can be traced as far back as the equivalent of at least half of the calendar years from the end of the year when the Fund member reached the age of 16 until the time that the disability is deemed to have occurred, the projected entitlements shall never be calculated as greater than the number of points that the Fund member has earned in pension funds until the time of the loss of ability.

11.14

The disability pension is the same percentage of the maximum disability pension as the disability is assessed, subject to Section 11.1. Disability pension is not paid for the first three months following loss of ability.

11.15

A disability pension is paid only if the disability and loss of income lasts for three months or longer.

11.16

A Fund member who applies for a disability pension from the Fund, or is taking such a pension, is required to provide the board of directors of the Fund with all information concerning his/her health and earnings necessary to determine his/her right to a pension.

11.17

The board shall reduce or cancel the disability pension of members who regain their ability to work in part or in full. In the same manner, the board of directors shall increase the disability pension if the disability increases significantly from previous assessments, provided that the Fund member has, from the time that the disability increased ,not been employed in a position where he/she earned pension entitlements in another pension fund.

11.18

A disability pension shall lapse at the age of 67 years. The old-age pension shall then be determined by adding to the earned entitlements the entitlements that were calculated in the proportion of the disability for the Fund member at the time of the determination of disability until the age of 65. However, such addition to earned entitlements shall never be so great as to bring the total entitlement for each calendar year to an amount exceeding the remuneration that is normal for the profession of the Fund member.

12.1

Where a Fund member dies, who was the recipient of an old-age or disability pension from the Fund, or had contributed to the Fund for a minimum of 24 months out of the 36 months preceding the decease, and is survived by a spouse, then the spouse is entitled to a pension from the Fund.

12.2

If a Fund member is survived by one or more children under the age of 19 years whom he/she had by the surviving spouse, a full spouse pension shall be paid up to the age of 19 of the youngest child. The same applies if the spouse supports a child that the Fund member supported before. Their adopted child shall entail the same right. Also, a spouse pension shall be granted to the spouse of Fund member if the Fund’s medical officer is of the opinion that the spouse lacks 50% or more of full capacity for work while this situation lasts, but never longer than until the age of 67 of the surviving spouse.

12.3

If entitlement to a spouse pension is established in accordance with Section 12.1, a full spouse pension shall be paid at a minimum for 48 months and a 50% spouse pension for an additional 36 months.

12.4

In the event of the death of a Fund member who does not fulfil the conditions of Section 12.1, and his/her spouse is not awarded a spouse pension in accordance with the above provisions, then a spouse pension shall nonetheless be paid for 24 months after the decease of the Fund member.

12.5

If a Fund member does not leave a spouse, but his/her single mother, an unmarried sister or another unmarried person has demonstrably taken care of his/her household for a number of years prior to his/her death, the board of directors of the Fund may pay a spouse pension to that person, as if that person were a widow or a widower. In the same manner, the board of directors is permitted to pay a pension to a co-habitant in accordance with the provisions of Section 12.4.

12.6

A spouse pension at any time shall amount to 50% of the old-age pension or disability pension of the Fund member, whichever gives the higher entitlement after death.

12.7

In addition to accrued entitlements, the entitlements shall be counted that the Fund member may be expected to have earned up to the age of 65 years, calculated in accordance with Section 11.9; however the average of entitlements shall never be based on a greater number of calendar years than those over which the Fund member has paid contributions. If the Fund member has enjoyed a disability pension from the Fund, the entitlements shall be calculated from the time that the Fund member was awarded a disability pension until the time that the spouse pension is awarded in conformity with the entitlements forming the basis of the disability pension. If the demise simultaneously entitles the surviving spouse to a pension from another fund, he/she shall only have a right to a permanent pension from this Fund if contributions were last paid to this Fund.

12.8

For the purposes of this Article, a spouse is defined as the person who, at the time of decease, was united in marriage or co-habitation with the deceased Fund member, provided that their joint estate has not been dissolved prior to the demise of the Fund member. Co-habitation means a union between two persons who live together at a common domicile, who have a child together or where the woman is pregnant, or co-habitation been continuous for at least two years. A spouse pension may be paid to a person who has demonstrably taken care of a Fund member’s household for a number of years prior to his/her demise. The entitlement to a spouse pension lapses if the spouse remarries, enters into co-habitation corresponding to marriage or enters into a registered partnership.

13.1

In the event of the demise of a Fund member who has paid contributions to the Fund for a minimum of 24 out of the 36 preceding months, or was taking an old-age pension or disability pension at the time of the demise, his/her surviving children and adopted children are entitled to a pension from the Fund until the age of 19 years.

13.2

If the death of the Fund member also entitles the children to a pension from another pension fund, the payment of a pension from this Fund , shall be subject to the condition that the Fund member last paid contributions to this Fund.

13.3

A full child pension in respect of the death of a Fund member is 22.088 ISK for each child for each calendar month. A full child pension is paid if the annual contribution base, estimated in accordance with Section 12.7, is at least 1.115.217 ISK. If the contribution base is lower, then the child pension from the Fund is reduced proportionally and shall lapse if the base corresponded to less than half of this figure.

13.4

If a Fund member is awarded a disability pension in accordance with Section 11.1 for reasons of 100% disability, his/her children, born before the loss of ability or in the next 12 months thereafter, as well as children adopted before the loss of ability, shall acquire the same right as the children of a deceased Fund member pursuant to Section 13.3, with the exception that the amount of a full child pension for each calendar month shall be 16.197 ISK for each child. If disability according to Article 11 is assessed as less than 100%, then the child pension shall be proportionately lower. A child pension paid in respect of the disability of a Fund member does not lapse if the Fund member reaches pensionable age.

13.5

Foster children and stepchildren mostly or fully supported by a Fund member shall be entitled to a child pension. The Fund’s pension payments in respect of such children shall be the same as in the case of natural or adopted children.

13.6

Child pensions are paid to the supporter of the child.

14.

Lapse of contributions

14.1

In the event that wage payments to a Fund member lapse as a result of illness or unemployment, the Fund member shall not earn entitlements while that remains the situation. Periods of time during which payments of contributions have demonstrably lapsed for these reasons shall not be counted when determining whether conditions regarding time of contributions have been fulfilled.

14.2

The entitlement to an old-age, disability or spouse pension shall not cease even when a Fund member ceases paying contributions. In such an event, the entitlement shall be based only on accrued, deferred points; see, however, Section 14.1.

15.

Refunding of contributions

15.1

The pension contributions of foreign nationals who cease their participation in the Fund for reasons of their leaving Iceland may be reimbursed in full, provided that such reimbursement is not prohibited under any international agreements to which Iceland is a party. It is permitted to deduct from a refunded contribution, with interest added, any cost of insurance coverage enjoyed by the Fund member and administration cost in accordance with an actuarial assessment. The refunding of contributions paid by citizens of other member states of the European Economic Area (EEA) and the Faroe Islands is prohibited according to current international agreements. The above also applies to reimbursement of pension savings in the personal savings plan.

15.2

When contributions are paid into the Fund in respect of employees who have reached the age of 70 years, or are younger 16 years of age, the Fund shall reimburse to Fund members and their employers their respective shares of the contributions.

16.

Agreements on reciprocal rights

16.1

The board of directors of the Fund is permitted to enter into agreements with other pension funds regarding the arrangement of transfers of entitlements etc. In such agreements deviations are permitted from the waiting periods and benefit provisions of these Statutes in order to prevent any lapse of entitlements when a Fund member changes employment and any duplicated assurance of entitlements that are not based on a past contribution period. Also, it is permitted to decide that independent entitlements in individual pension funds should not in the aggregate exceed the entitlements that would accrue in one and the same fund. However, such agreements are not binding for the Fund until they have been approved by the Ministry of Finance.

17.

Arrangement of pension payments

17.1

A pension is paid monthly in arrears, for the first time in the month following the month when the right to a pension was established and for the last time in the month when , the right to a pension lapses.

17.2

The board of directors of the Fund is permitted to award a disability pension, spouse pension and child pension up to two years retroactively from the beginning of the month in which a satisfactory application is received by the Fund. A satisfactory application for a pension is not regarded as received until all required attachments with the application are received. An award shall be based on rules of entitlement as they stood in the period in question and the pension on the price level of each period. No interest accrues to pension payments.

17.3

A Fund member may decide that up to a half of his contributions or retirement pension payments should accrue to his/her spouse or ex-spouse. An agreement to such effect should, as applicable, extend to old-age pension payments, the value of old-age pension entitlements or the old-age pension entitlements of both persons, and provide for a mutual and equal division of entitlements earned during the time that the marriage, cohabitation or registered partnership has existed or may exist.

- Up to one-half of old-age pension payments accruing to the Fund member may accrue to the Fund member’s spouse or former spouse. In the event of the decease of the spouse or ex-spouse taking such payments before the decease of the Fund member, the full payments shall accrue to the Fund member.

- Before the taking of a pension is begun, but not later than prior to 65 years of age, and provided life-expectancy is not reduced by sickness or ill-health, a Fund member may elect that up to a half of the value of his/her cumulative earned old-age pension entitlements should accrue to independent old-age pension entitlements for his/her spouse or ex-spouse, in which case the entitlements of the Fund member shall be curtailed accordingly. However, the total liability of the Fund shall not be increased by such a decision of the Fund member.

- That up to a half of a Fund member’s contributions should accrue to the establishment of independent entitlements for the Fund member’s spouse.

17.4

Where a pension payment does not come to an amount corresponding to at least 5.576 ISK, and it is apparent that there will be no combination with other entitlements, the board of directors of the Fund may make the payment in a lump sum in accordance with the recommendation of an actuary.

18.

Specified Personal Savings Department of the General Pension and Insurance Fund

18.1

A Fund member may dispose of up to 3.5% of the contribution from the contribution base in excess of 12% of the contribution base to the Fund’s Specified Personal Savings Department, if provided for in a collective agreement or employment contract.

18.2

The board of directors of the Fund is also the board of directors of the Private Pension Department.

18.3

Persons requesting membership of the specified personal savings plan shall notify the Fund in a verifiable manner in accordance with the rules established by the Fund in compliance with the provisions of applicable laws and regulations. Fund members can, in the same manner, give notice that they wish to discontinue their payments to the Specified Personal Savings Department, in which case their contributions shall accrue to the Mutual Insurance Department.

18.4

The Fund shall make changes in the allocation of a contribution in accordance with the notified decision of a Fund member according to the above as promptly as possible, and no later than two calendar months from the time that the notification is received in a verifiable manner. A decision on a change in the allocation of a contribution for the future shall not affect a contribution that has previously been allocated.

18.5

Contributions paid into the specified personal savings plan shall be the private asset of the right holder making the payment. A contribution to the specified personal savings plan does not confer an entitlement to a predetermined pension; instead, payments out of the Fund shall be based on the holdings of the member in question.

18.6

A Fund member (right holder) is permitted to begin withdrawals from the Specified Personal Savings Department from the age of 62, in which case payments shall be distributed at a minimum over the period remaining to him/her until the age of 67. At the request of the right holder deviation is permitted from the above payment period if the balance is below 1.478.386 ISK.

18.7

A right holder, who for reasons of disability needs to cease work before reaching the age of 62 years, is entitled to payment of his/her balance in the Specified Personal Savings Department, paid in equal monthly payments over a period of not less than seven years. In the event that the percentage of disability is less than 100%, the annual payment shall be reduced in proportion to the reduced percentage of disability and the payment period extended accordingly. At the request of the right holder deviation is permitted from the above payment period if the balance is below ISK 1.478.386.

18.8

In the event of the decease of a right holder before the balance is fully paid out, it shall accrue to his/her heirs and be divided among them in accordance with the rules of the Inheritance Act. If a right holder does not leave a spouse or a child, the holding shall accrue to the estate without the limitations provided for in the second sentence of Section 8.2 of Act No. 129/1997.

18.9

The board of directors of the Fund is permitted to offer one or more investment plans in the Specified Personal Savings Department. A separate investment strategy shall be established for each individual investment plan in accordance with Article 36 of Act No. 129/1997. If more than one investment plan is offered, the Fund member shall state his/her selection of plan by a notification to the Fund in a form decided by the Fund. If the Fund offers more than one investment plan, a Fund member may request a transfer between investment plans under the rules established by the board of directors of the Fund.

18.10

The operation of the Specified Personal Savings Department shall be financially segregated from the operation of the Fund and other departments. Joint expenses shall be shared in a reasonable and unequivocal manner between the operating segments of the Fund's departments. The custody and operating of the investment portfolio of the Specified Personal Savings Department in combination with the portfolios of other departments of the Fund is permitted. Each department then holds a proportional claim to the portfolio and participates proportionally in expenses.

18.11

Right holders are not permitted to assign, pledge or dispose in any other manner of the balance or entitlements in Specified Personal Savings Department except as specifically permitted according to Act No. 129/1997.

18.12

A statement shall be sent at least once a year of contributions paid and their balances. A decision may be made to send more frequent statements as approved by the board of directors.

19.

Personal Savings Department of the General Pension and Insurance Fund

19.1

The General Pension and Insurance Fund shall operate a Personal Savings Department to take delivery of supplementary contributions The role of the Department is to secure pensions for its members and their heirs in accordance with the provisions of the Charter of the Department.

19.2

Membership of the Personal Savings Department is open to all persons who contribute to the General Pension and Insurance Fund and meet conditions relating to minimum insurance coverage as defined at a minimum in the Act on the activities of pension funds. Furthermore, individuals who are required to contribute to other pension funds may pay a supplementary contribution to the Personal Savings Department.

19.3

Persons wishing to become right holders shall send to the board of directors a written agreement on pension savings, which constitutes their statement that they wish to comply with the charter of the Personal Savings Department. The agreement shall be issued in duplicate, with one copy to be held by the right holder and another by the Department.

19.4

A contribution to the Personal Savings Department does not confer entitlements or a predetermined pension.

19.5

A separate account shall be kept of the contributions of each right holder to the Personal Savings Department

19.6

The returns on each personal account shall be numerically the same as the net returns of the department, but in the calculation of net returns the operating expenses of the Department in excess of operating revenues shall be deducted from the investment earnings.

19.7

The interest to be deposited into individual personal accounts at year-end shall be calculated so that the interest on each personal account is calculated on holdings at the beginning of the year and on deposits and withdrawals over the course of the year in line with the net real return on investment of the Personal Savings Department.

20.

Personal Savings Department

20.1

If an individual who has previously been a right holder in another pension fund becomes a member of the Personal Savings Department, the board of directors of the Department is permitted to accept as a lump sum the funds that he/she may be paid out of the fund that he/she is transferring from.

20.2

The Personal Savings Department shall send a statement at least once a year of contributions paid and their balances. A decision may be made to send more frequent statements as approved by the board of directors.

21.

Personal Savings Department

21.1

The funds contributed in the name of a right holder shall constitute his/her personal assets. In addition, all income from interest and price level adjustments that the Department receives in respect of the member’s assets in the Department shall be credited to the members account.

21.2

The net income of the department shall be divided among right holders in proportion to their holdings and accrue annually to their personal accounts.

22.

Personal Savings Department

22.1

The first withdrawal may be made on a balance, or a special withdrawal agreement concluded, two years after the first payment of a contribution toward personal pension entitlements, but not before the right holder has met certain additional conditions provided for in Sections 22.2-22.6.

22.2

When a right holder has reached the age of 60 years pension savings many be disbursed, with interest.

22.3

Should a right holder become disabled, and if the disability is 100%, he/she shall be entitled to have his/her pension savings and interest disbursed in equal annual payments over a period of seven years. In the event that the percentage of disability is less than 100%, the annual payment shall be reduced in proportion to the reduced percentage of disability and the payment period extended accordingly.

22.4

Regular payments in this context means equal payments relative to the number of payment years, so that the Fund member receives, in each year, the portion of his or her balance, including income accruing to the balance, which corresponds to the number of years remaining of the repayment period.

22.5

In the event of the decease of a right holder before the balance is fully paid out, it shall accrue to his/her heirs and be divided among them in accordance with the rules of the Inheritance Act.

If a right holder does not leave a spouse or a child, the holding shall accrue to the estate without the limitations pursuant to the second sentence of Section 8.2 of Act No. 129/1997.

22.6

A right holder and the recipient of payments may enter into a separate agreement on a monthly disbursement of a certain amount in ISK, to be linked to the consumer price index. This agreement may, in part or in full, be limited to a specified period, or it may be effective for the remainder of the life of the right holder.

23.

Personal Savings Department

23.1

An agreement on pension savings may be terminated with two months’ notice. The termination shall take effect as soon as notice of the termination has been given to the board of directors.

24.

Personal Savings Department

24.1

Termination does not give rise to a right to disbursement; it is only permitted to transfer an existing balance to another depositary approved by the Financial Supervisory Authority as a depositary in compliance with Article 8 of Act No. 129/1997.

24.2

On the termination by a right holder and the transfer of the balance of the right holder to another depositary, all of his/her balance shall be transferred.

24.3

The reimbursement amount constitutes the balance of the right holder, net of cost, which amounts to 1% of the balance of the Fund member, provided that he/she has contributed to the Department for less than 36 months from the first deposit.

25.

Personal Savings Department

25.1

The assets of the Personal Savings Department shall be invested in accordance with Article 7 of the Fund’s statutes and Act No. 129/1997 and the investment strategy of the Department.

26.

Personal Savings Department

26.1

The board of directors of the General Pension and Insurance Fund shall be the board of directors of the Personal Savings Department and handle its affairs.

27.

Personal Savings Department

27.1

The General Pension and Insurance Fund is responsible for the day-to-day operation of the Personal Savings Department in accordance with Article on of the Act on the Fund No. 155/1998. The operation of the Personal Savings Department and the investment of contributions shall be financially segregated from other functioning of the Fund in all respects.

The financial year of the Personal Savings Department shall be the calendar year.

28.

Personal Savings Department

28.1

Holdings in the Personal Savings Department shall not be assigned or pledged, in full or in part, e.g. individual disbursements.

29.

No assignment or pledges of pensions

29.1

An entitlement to a pension cannot be assigned or pledged.

30.

Procedure and arbitration

30.1

In its procedures the Fund shall take account of the fundamental rules of administrative law.

30.2

If a Fund member or his/her heirs do not accept the decision of the board of directors of the Fund in a matter referred to the board, they may refer the dispute to an arbitration tribunal within three months of the notification of the decision. The arbitration tribunal shall be composed of three members, one nominated by the Fund member, one by the Pension Fund and the third nominated by the Financial Supervisory Authority. The arbitration tribunal shall rule on the matter on the basis of the claims, evidence, merits and other information that was available to the board of directors when the board adopted a decision on the matter. If new claims, evidence and merits appear in the course of procedure before the arbitration tribunal the matter shall be referred back to the board of directors of the Fund for reopening. The board of directors is then required to reopen the case for a decision. The decision of the arbitration tribunal is final for both parties.

The cost of arbitration shall be divided among the parties to the case, with the Fund member, however, never paying more than 1/3 of the cost of arbitration. Proceedings before the arbitration tribunal shall in other respects be subject to the Act on contractual arbitration.

31.1

The Central Bank of Iceland supervises the Fund’s activities in accordance with Act No. 129/1997 and Act No 87/1998. Where reference is made to the Financial Supervisory Authority in these Statutes the reference is to the Central Bank of Iceland, see the Act on the Central Bank of Iceland No. 92/2019.

32.

Amendments to the Statutes

32.1

Amendment of the Statutes of the General Pension and Insurance Fund are entrusted to the board of directors; amendments require confirmation by the Minister following consultation with the Financial Supervisory Authority.

33.1

These Statutes replace the Statutes of the Fund of 19 June 2018 and shall take effect subject to the approval of the Ministry of Finance following consultation with the Financial Supervisory Authority. The amendments shall take effect on 1 September 2022; however, if the Minister has not confirmed the amendments before that time they shall take effect on the first business day of the month following their confirmation by the Minister

33.2

Entitlement tables in Annex A and Interim Provision 1 shall take effect on 1 January 2023.